How to Slash Your Mortgage Interest and Save Big Without Refinancing! Discover Your Potential Savings Now!

How to Slash Your Mortgage Interest and Save Big Without Refinancing! Discover Your Potential Savings Now!

A powerful yet simple strategy can save you a significant amount on your mortgage. This guide will walk you through everything you need to know about making extra monthly payments on your principal amount. The thought of paying off a mortgage can seem like facing a giant with a slingshot. But what if I told you that slingshot is more powerful than you think? Making extra payments on your mortgage principal every month is like adding stones to that slingshot, giving you more power against the giant that is your mortgage. Even small extra payments can lead to substantial savings on interest and time.

substantial savings on interest and time.

Unveiling the Power of Extra Payments

When discussing mortgages, we talk about more than just a monthly payment. We’re talking about interest, principal, and the long journey to owning your home outright. By adding a little extra to your monthly payments, you’re paying off your debt faster and reducing the amount of interest you pay over the life of your loan. It’s like giving yourself a pay raise by saving money in the long run. Even a little extra can make a big difference!

You will be surprised to see the amount of savings added to your bottom line! Let’s unveil the magic of extra payments together.

The Impact of Extra Payments on Your Long-term Financial Goals

Imagine reaching your financial goals sooner rather than later. Whether it’s saving for retirement, your child’s education, or that dream vacation, extra mortgage payments can free up your budget sooner for these goals. It’s about making your money work smarter, not harder.

Why Make Extra Payments Towards Your Mortgage?

Interest Savings: How Extra Payments Reduce the Total Interest Paid

By paying more towards your principal, the interest computed on the remaining balance decreases, which means more of your future payments go towards reducing the principal than paying off interest. It’s a beautiful cycle of savings that starts with just a bit more from your pocket each month.

Accelerating Equity Growth: Building Your Home’s Equity Faster

Extra payments increase the equity you have in your home at a quicker rate. This is crucial if you want to refinance or need a loan against your home’s equity. Knowing your nest is more yours with every payment is always comforting.

Shortening the Loan Term: The Road to Mortgage-Free Living

The dream of burning that mortgage paper doesn’t have to be far away. Extra payments can significantly reduce the time it takes to say goodbye to your mortgage, sometimes by several years!

Scenario Example #1

In this scenario, we are considering a property with a Purchase Price of $1,000,000. The Financing Amount or Principal Amount for this property is $800,000, with an Interest Rate of 6%. The Down Payment made is 20% or $200,000 of the House Price. The loan begins in June 2024 and is structured as a 30-year Mortgage Loan.

| House Price: $1,000,000 | Finance Amount: $800,000 | Interest Rate: 6% | Down Payment: 20% or $200,000 |

Standard Scenario: Without any Extra Payments

Over the entire 30-year loan term, without any additional payments beyond the monthly installment, the following breakdown is observed:

This breakdown provides a detailed understanding of how the payments are distributed between interest and principal over the entire duration of the 30-year mortgage loan.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,726,705.51 | $4,796.40 | $926,705.51 (54%) | $800,000 (46%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $0 | $0 | 360 | June 2024 | June 2054 |

Success Strategies: With Extra Payments

$1,000 Extra Monthly Payment

You could save $365,271 on Interest and reduce the loan term by 10 years and 5 months, so you can pay it off in over 19 years and 7 months instead of 30 years.

This breakdown provides a detailed understanding of how the payments are distributed between interest and principal over the entire duration of the 30-year mortgage loan.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,127,154.99 | $4,796.40 | $561,434.27 (41%) | $800,000 (59%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $234,279.29 | $365,271.24 | 235 | June 2024 | Jan. 2044 |

$1,100 Extra Monthly Payment

You could save $385,604 on Interest and reduce the loan term by 11 years, so you can pay it off in over 19 years instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,091,401.54 | $4,796.40 | $541,101.54 (40%) | $800,000 (60%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $249,700 | $385,603.97 | 228 | June 2024 | Jun. 2043 |

$1,200 Extra Monthly Payment

You could save Interest by $404,423 and reduce the loan term by 11 years and 5 months, so you can pay it off in over 18 years and 5 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,058,282.31 | $4,796.40 | $522,282.31 (39%) | $800,000 (61%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $264,000 | $404,423.21 | 221 | June 2024 | Nov. 2042 |

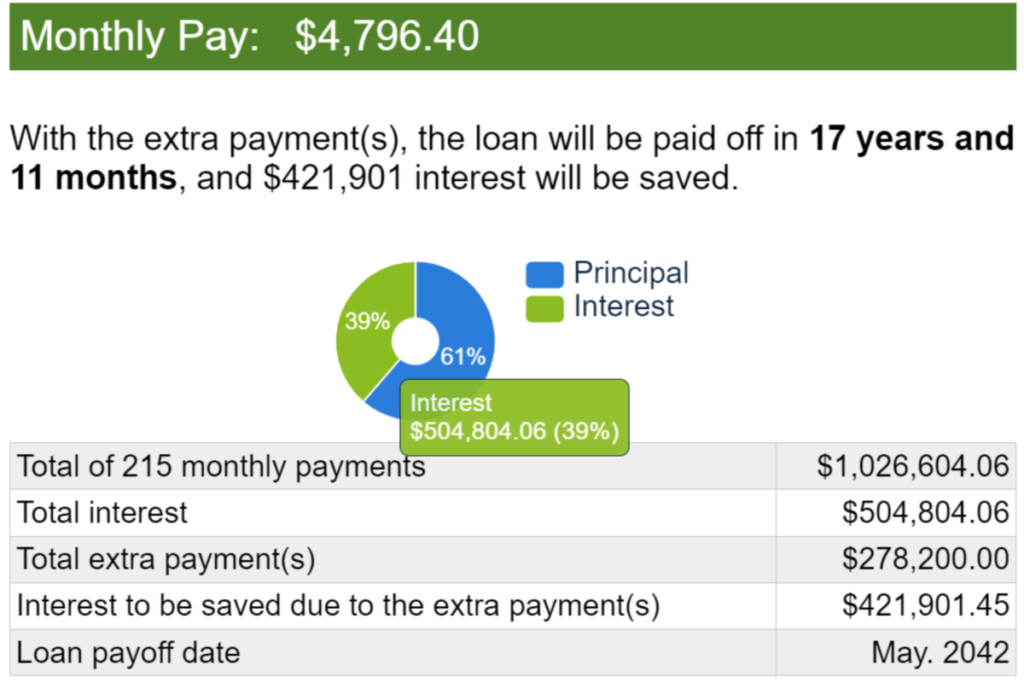

$1,300 Extra Monthly Payment

You could save $421,901 on Interest and reduce the loan term by 12 years and 1 month, so you can pay it off in over 17 years and 11 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,026,604.06 | $4,796.40 | $504,804.06 (39%) | $800,000 (61%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $278,200 | $421,901.45 | 215 | June 2024 | May. 2042 |

$1,400 Extra Monthly Payment

You could save Interest by $438,177 and reduce the loan term by 12 years and 8 months, so you can pay it off in over 17 years and 4 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $997,652.07 | $4,796.40 | $488,528.52 (38%) | $800,000 (62%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $290,876.45 | $438,176.99 | 208 | June 2024 | Oct. 2041 |

$1,500 Extra Monthly Payment

You could save Interest by $453,376 on interest and reduce the loan term by 13 years and 1 month, so you can pay it off in over 16 years and 11 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $970,329.26 | $4,796.40 | $473,329.26 (37%) | $800,000 (63%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $303,000 | $453,376.26 | 203 | June 2024 | May. 2041 |

How much Interest and Time did you save?

Considering a house price of $1,000,000, with a finance amount of $800,000, an interest rate of 6%, and a down payment of 20% or $400,000, let’s explore the impact of additional monthly payments:

- $1,000 extra monthly payment: You could save Interest by $365,271 and reduce the loan term by 10 years and 5 months.

- $1,100 extra monthly payment: You could save Interest by $385,604 and reduce the loan term by 11 years.

- $1,200 extra monthly payment: You could save Interest by $404,423 and reduce the loan term by 11 years and 5 months.

- $1,300 extra monthly payment: You could save Interest by $421,901 and reduce the loan term by 12 years and 1 month.

- $1,400 extra monthly payment: You could save Interest by $438,177 and reduce the loan term by 12 years and 8 months.

- $1,500 extra monthly payment: You could save Interest by $453,376 and reduce the loan term by 13 years and 1 month.

Scenario Example #2

In this scenario, we are considering a property with a Purchase Price of $1,250,000. The Financing Amount or Principal Amount for this property is $1,000,000, with an Interest Rate of 6%. The Down Payment made is 20% or $250,000 of the House Price. The loan begins in June 2024 and is structured as a 30-year Mortgage Loan.

| House Price: $1,250,000 | Finance Amount: $1,000,000 | Interest Rate: 6% | Down Payment: 20% or $250,000 |

Standard Scenario: Without any Extra Payments

Over the entire 30-year loan term, without any additional payments beyond the monthly installment, the following breakdown is observed:

This breakdown provides a detailed understanding of how the payments are distributed between interest and principal over the entire duration of the 30-year mortgage loan.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $2,158,381.89 | $5,995.51 | $1,158,381.89 (54%) | $1,000,000(46%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $0 | $0 | 360 | June 2024 | June 2054 |

Success Strategies: With Extra Payments

$1,000 Extra Monthly Payment

You could save Interest by $399,003 and reduce the loan term by 9 years, so you can pay it off in over 21 years instead of 30 years.

This breakdown provides a detailed understanding of how the payments are distributed between interest and principal over the entire duration of the 30-year mortgage loan.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,508,379.3 | $5,995.51 | $759,379.36 (43%) | $1,000,000 (57%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $251,000 | $399,002.53 | 252 | June 2024 | June 2045 |

$1,100 Extra Monthly Payment

You could save $423,224 on Interest and reduce the loan term by 10 years and 7 months, so you can pay it off in over 20 years and 5 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,466,758.34 | $5,995.51 | $735,158.34 (42%) | $1,000,000 (58%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $268,400 | $423,223.55 | 245 | June 2024 | Nov 2054 |

$1,200 Extra Monthly Payment

You could save Interest by $445,838 and reduce the loan term by 10 years and 1 month, so you can pay it off in over 19 years and 11 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,426,943.96 | $5,995.51 | $712,543.96 (42%) | $1,000,000 (58%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $285,600 | $445,837.93 | 239 | June 2024 | May 2054 |

$1,300 Extra Monthly Payment

You could save $466,998 on Interest and reduce the loan term by 9 years and 8 months, so you can pay it off in over 19 years and 4 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,390,957.22 | $5,995.51 | $691,383.39 (41%) | $1,000,000 (59%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $300,426.17 | $466,998.50 | 232 | June 2024 | Oct. 2043 |

$1,400 Extra Monthly Payment

You could save $486,858 on Interest and reduce the loan term by 11 years and 1 month, so you can pay it off in over 18 years and 11 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,355,123.71 | $5,995.51 | $671,523.71 (40%) | $1,000,000 (60%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $316,400 | $486,858.18 | 227 | June 2024 | May. 2043 |

$1,500 Extra Monthly Payment

You could save $505,529 on Interest and reduce the loan term by 11 years and 7 months, so you can pay it off in over 18 years and 5 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,322,852.88 | $5,995.51 | $652,852.88 (39%) | $1,000,000 (61%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $330,000 | $505,529.01 | 221 | June 2024 | May. 2043 |

How much Interest and Time did you save?

Considering a house price of $1,250,000, with a finance amount of $1,000,000, an interest rate of 6%, and a down payment of 20% or $250,000, let’s explore the impact of additional monthly payments:

- $1,000 extra monthly payment: You could save Interest by $399,003 and reduce the loan term by 9 years.

- $1,100 extra monthly payment: You could save Interest by $423,224 and reduce the loan term by 10 years and 7 months.

- $1,200 extra monthly payment: You could save Interest by $445,838 and reduce the loan term by 10 years and 1 month.

- $1,300 extra monthly payment: You could save Interest by $466,998 and reduce the loan term by 9 years and 8 months.

- $1,400 extra monthly payment: You could save Interest by $486,858 and reduce the loan term by 11 years and 1 month.

- $1,500 extra monthly payment: You could save Interest by $505,529 and reduce the loan term by 11 years and 7 months.

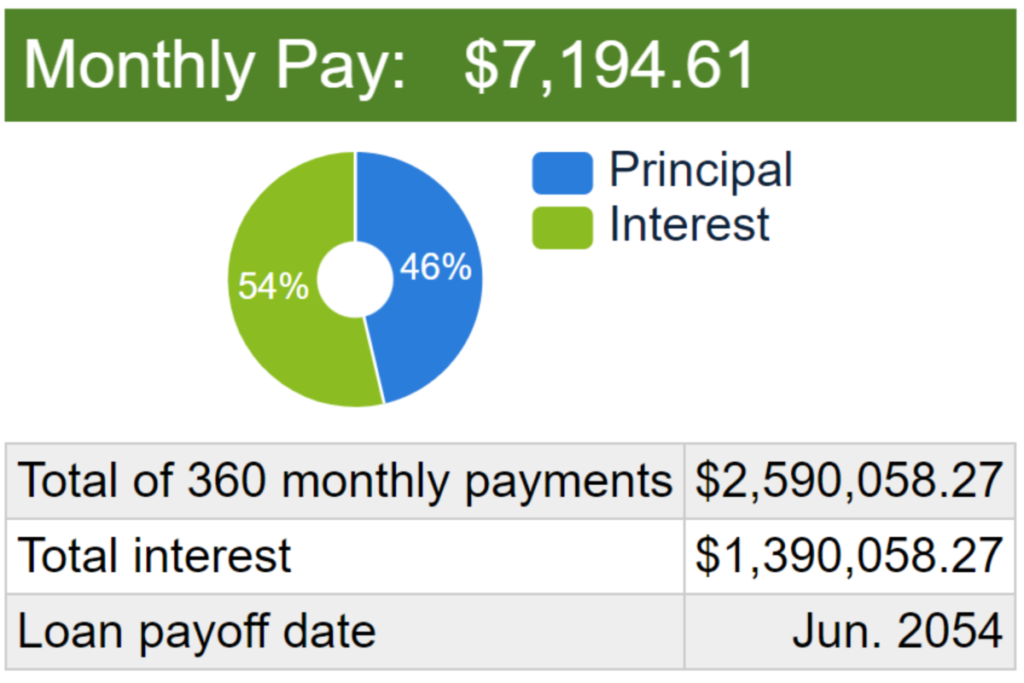

Scenario Example #3

In this scenario, we are considering a property with a Purchase Price of $1,500,000. The Financing Amount or Principal Amount for this property is $1,200,000, with an Interest Rate of 6%. The Down Payment made is 20% or $300,000 of the House Price. The loan begins in June 2024 and is structured as a 30-year Mortgage Loan.

| House Price: $1,500,000 | Finance Amount: $1,200,000 | Interest Rate: 6% | Down Payment: 20% or $300,000 |

Standard Scenario: Without any Extra Payments

Over the entire 30-year loan term, without any additional payments beyond the monthly installment, the following breakdown is observed:

This breakdown provides a detailed understanding of how the payments are distributed between interest and principal over the entire duration of the 30-year mortgage loan.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $2,590,058.27 | $7,194.61 | $1,390,058.27 (54%) | $1,200,000 (46%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $0 | $0 | 360 | June 2024 | June 2054 |

Success Strategies: With Extra Payments

$1,000 Extra Monthly Payment

You could save $425,427 on Interest and reduce the loan term by 7 years and 11 months, so you can pay it off in over 22 years and 1 month instead of 30 years.

This breakdown provides a detailed understanding of how the payments are distributed between interest and principal over the entire duration of the 30-year mortgage loan.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,900,631.58 | $7,194.61 | $964,631.58 (45%) | $1,200,000 (55%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $264,000 | $425,426.69 | 265 | June 2024 | Jul. 2046 |

$1,100 Extra Monthly Payment

You could save $452,941 on Interest and reduce the loan term by 8 years and 6 months, so you can pay it off in over 21 years and 6 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,854,416.84 | $7,194.61 | $937,116.84 (44%) | $1,200,000 (56%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $282,700 | $452,941.42 | 258 | June 2024 | Dec. 2045 |

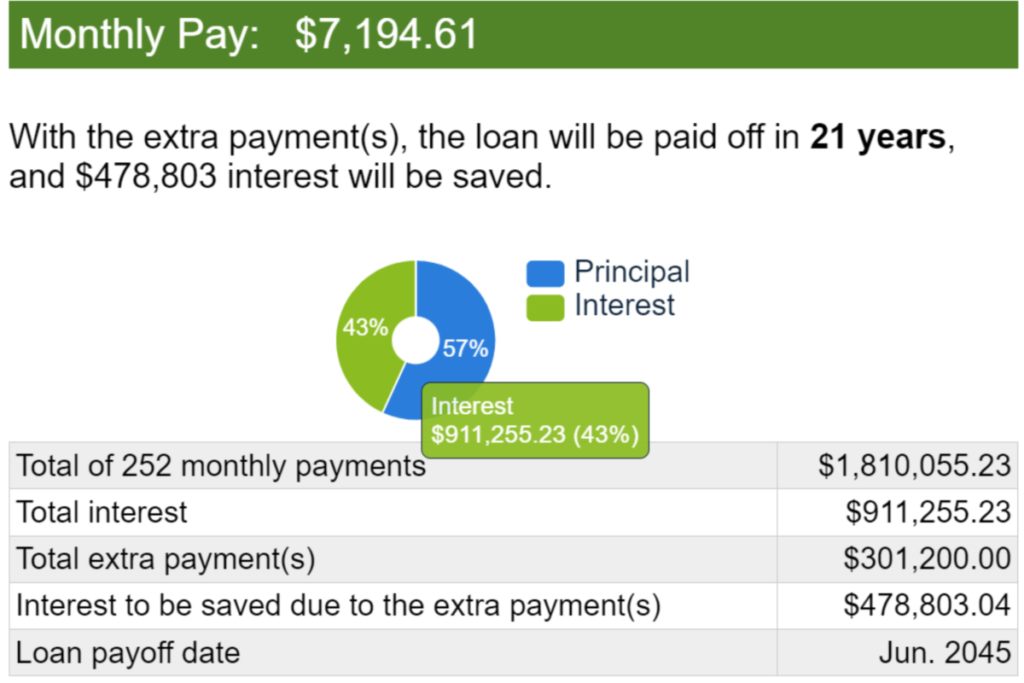

$1,200 Extra Monthly Payment

You could save $478,803 on Interest and reduce the loan term by 9 years, so you can pay it off in over 21 years instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,810,055.23 | $7,194.61 | $911,255.23 (43%) | $1,200,000 (57%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $301,200 | $404,423.21 | 252 | June 2024 | Jun. 2045 |

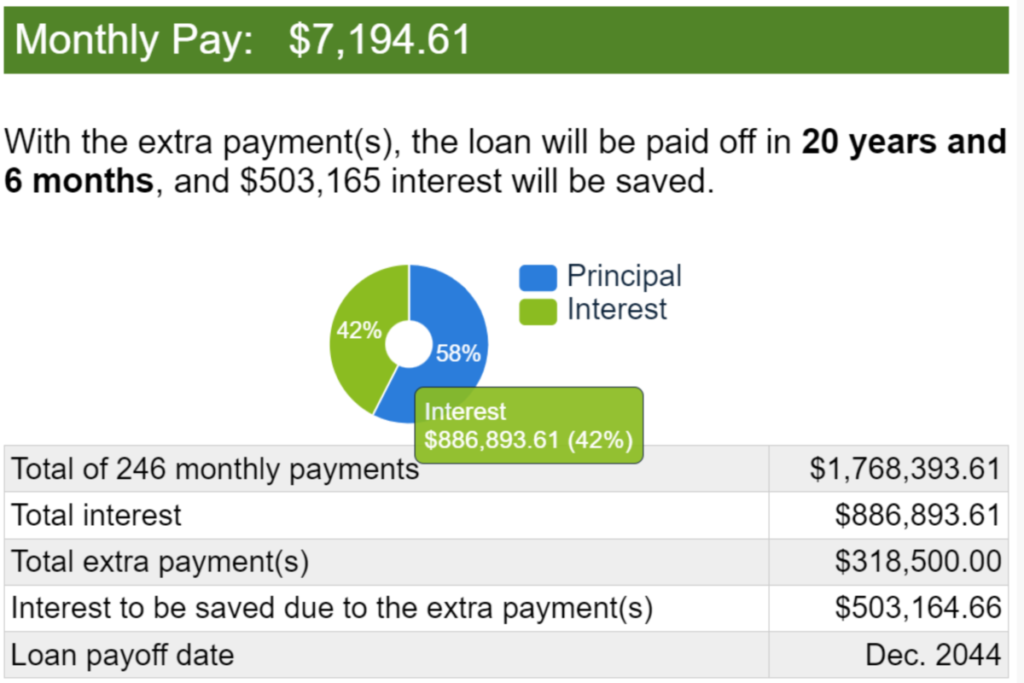

$1,300 Extra Monthly Payment

You could save $503,165 on Interest and reduce the loan term by 9 years and 6 months, so you can pay it off in over 20 years and 6 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,768,393.61 | $7,194.61 | $886,893.61 (42%) | $1,200,000 (58%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $318,500 | $503,164.66 | 246 | June 2024 | Dec. 2044 |

$1,400 Extra Monthly Payment

You could save Interest by $438,177 and reduce the loan term by 12 years and 8 months, so you can pay it off in over 20 years and 1 month instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,727,897.22 | $7,194.61 | $863,897.22 (42%) | $1,200,000 (58%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $336,000 | $526,161.05 | 241 | June 2024 | Jul. 2044 |

$1,500 Extra Monthly Payment

You could save Interest by $547,907 and reduce the loan term by 10 years and 5 months, so you can pay it off in over 19 years and 7 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $1,690,732.48 | $7,194.61 | $842,151.41 (41%) | $1,200,000 (58%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $351,418.93 | $547,906.86 | 241 | June 2024 | Jan. 2044 |

How much Interest and Time did you save?

Considering a house price of $1,500,000, with a finance amount of $1,200,000, an interest rate of 6%, and a down payment of 20% or $400,000, let’s explore the impact of additional monthly payments:

- $1,000 extra monthly payment: You could save Interest by $425,427 and reduce the loan term by 7 years and 11 months.

- $1,100 extra monthly payment: You could save Interest by $452,941 and reduce the loan term by 8 years and 6 months.

- $1,200 extra monthly payment: You could save Interest by $478,803 and reduce the loan term by 9 years.

- $1,300 extra payment each month: You could save Interest by $503,165 and reduce the loan term by 9 years and 6 months.

- $1,400 extra payment each month: You could save Interest by $526,161 and reduce the loan term by 9 years and 11 months.

- $1,500 extra payment each month: You could save Interest by $547,9078 and reduce the loan term by 10 years and 5 months.

Scenario Example #4

In this scenario, we are considering a property with a Purchase Price of $2,000,000. The Financing Amount or Principal Amount for this property is $1,600,000, with an Interest Rate of 6%. The Down Payment made is 20% or $400,000 of the House Price. The loan begins in June 2024 and is structured as a 30-year Mortgage Loan.

| House Price: $2,000,000 | Finance Amount: $1,600,000 | Interest Rate: 6% | Down Payment: 20% or $400,000 |

Standard Scenario: Without any Extra Payments

Over the entire 30-year loan term, without any additional payments beyond the monthly installment, the following breakdown is observed:

This breakdown provides a detailed understanding of how the payments are distributed between interest and principal over the entire duration of the 30-year mortgage loan.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $3,453,411.02 | $9,592.81 | $1,853,411.02 (54%) | $1,600,000 (46%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $0 | $0 | 360 | June 2024 | June 2054 |

Success Strategies: With Extra Payments

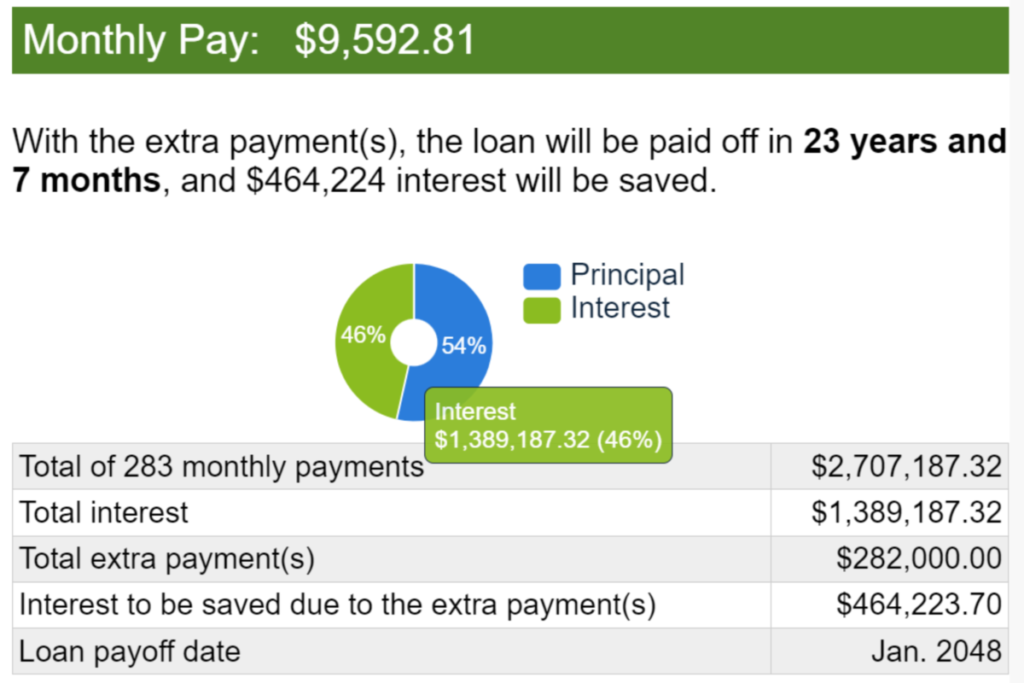

$1,000 Extra Monthly Payment

You could save Interest by $464,224 on Interest and reduce the loan term by 6 years and 5 months, so you can pay it off in over 23 years and 7 months instead of 30 years.

This breakdown provides a detailed understanding of how the payments are distributed between interest and principal over the entire duration of the 30-year mortgage loan.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $2,707,187.32 | $9,592.81 | $1,389,187.32 (46%) | $1,600,000 (54%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $282,000 | $464,223.70 | 283 | June 2024 | Jan. 2048 |

$1,100 Extra Monthly Payment

You could save $496,990 on Interest and reduce the loan term by 6 years and 11 months, so you can pay it off in over 23 years and 1 month instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $2,652,821.35 | $9,592.81 | $1,356,421.35 (46%) | $1,600,000 (54%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $303,600 | $496,989.67 | 277 | June 2024 | Jul. 2047 |

$1,200 Extra Monthly Payment

You could save Interest by $528,107 and reduce the loan term by 7 years and 4 months, so you can pay it off in over 22 years 8 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $2,600,103.53 | $9,592.81 | $1,325,303.53 (45%) | $1,600,000 (55%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $325,200 | $528,107.49 | 272 | June 2024 | Feb. 2047 |

$1,300 Extra Monthly Payment

You could save $557,692 on Interest and reduce the loan term by 7 years and 10 months, so you can pay it off in over 22 years and 2 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $2,551,219.40 | $9,592.81 | $1,295,719.40 (45%) | $1,600,000 (55%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $344,500 | $557,691.62 | 266 | June 2024 | Aug. 2046 |

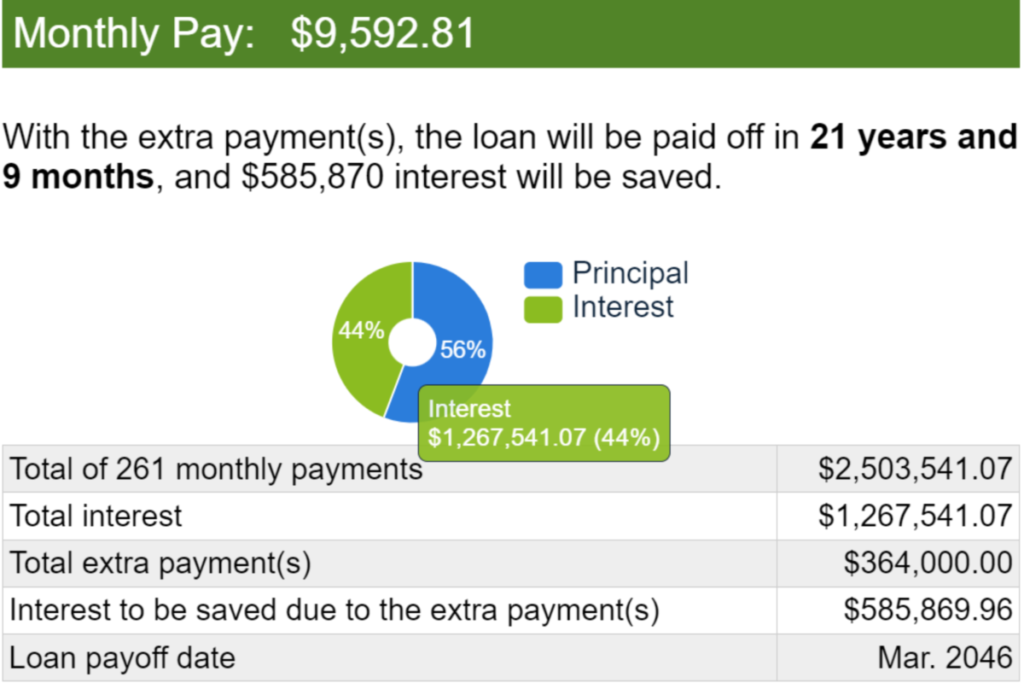

$1,400 Extra Monthly Payment

You could save Interest by $585,870 and reduce the loan term by 8 years 5 months, so you can pay it off in over 21 years 9 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $2,503,541.07 | $9,592.81 | $1,267,541.07 (44%) | $1,600,000 (56%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $364,000.00 | $585,869.96 | 261 | June 2024 | March 2046 |

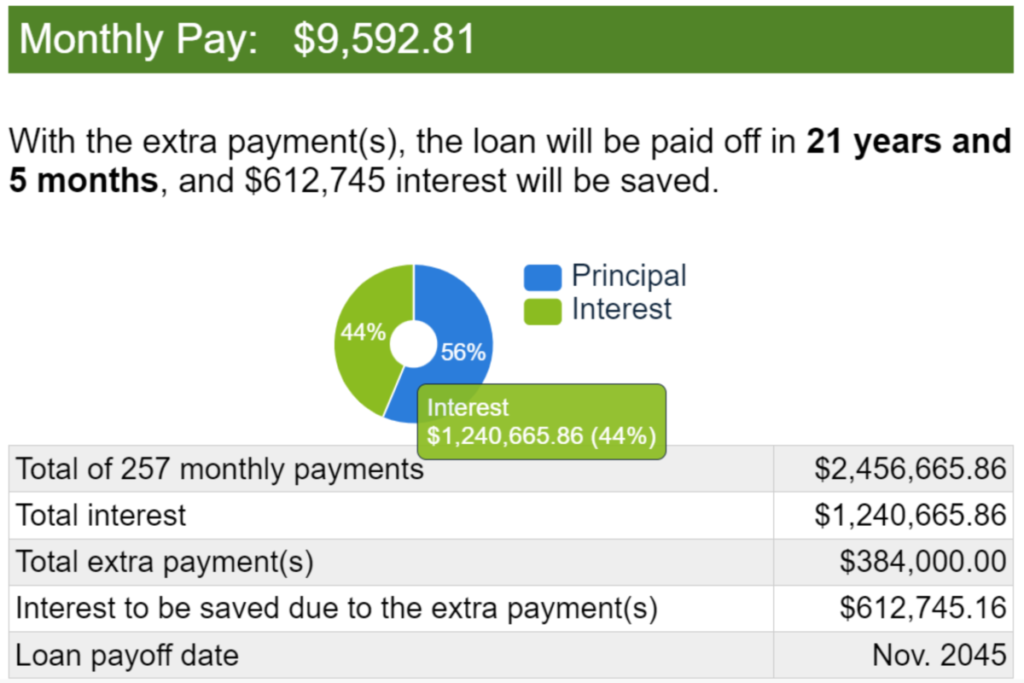

$1,500 Extra Monthly Payment

You could save $612,745 on Interest and reduce the loan term by 8 years and 7 months, so you can pay it off in over 121 years and 5 months instead of 30 years.

| Total Amount | Monthly Pay | Total Interest | Principal Amount |

| $2,456,665.86 | $9,592.81 | $1,240,665.86 (44%) | $1,600,000 (56%) |

| Total EXTRA payment | Interest saved from EXTRA payments | Total Months | Loan Start date | Loan Payoff date |

| $384,000 | $612,745.16 | 257 | June 2024 | Nov. 2045 |

How much Interest and Time did you save?

Considering a house price of $2,000,000, with a finance amount of $1,600,000, an interest rate of 6%, and a down payment of 20% or $400,000, let’s explore the impact of additional monthly payments:

- $1,000 extra payment each month: You could save Interest by $464,224 and reduce the loan term by 6 years and 5 months.

- $1,100 extra payment each month: You could save Interest by $496,990 and reduce the loan term by 6 years and 11 months.

- $1,200 extra payment each month: You could save Interest by $528,107 and reduce the loan term by 7 years and 4 months.

- $1,300 extra payment each month: You could save Interest by $557,692 and reduce the loan term by 7 years and 10 months.

- $1,400 extra payment each month: You could save Interest by $585,870 and reduce the loan term by 8 years and 5 months.

- $1,500 extra payment each month: You could save Interest by $612,745 and reduce the loan term by 8 years and 7 months.

Tips for Staying Motivated Throughout Your Mortgage Repayment Journey

- Visualize Your Progress – Keep a chart or spreadsheet that tracks how much you’ve reduced your mortgage.

- Celebrate Milestones – Paid off an extra $1,000? Celebrate these wins to stay motivated.

- Remind Yourself of the End Goal – Remember why you’re doing this. Whether it’s for retirement savings, peace of mind, or financial freedom, keeping your goal in sight can give you the push you need.

Crafting Your Extra Payment Strategy

Assessing Your Financial Health: Budgeting for Extra Payments

Before you start making extra payments, take a good look at your budget. Ensure that your essentials are covered, and consider what amount you’re comfortable adding to your mortgage payments. Even a little extra can make a big difference!

Fixed vs. Variable Extra Payments: Choosing Your Approach

Your budget might have more wiggle room in some months. You can choose a fixed extra amount to pay monthly or vary your extra payments based on your financial situation. Both strategies have benefits, so consider which fits your lifestyle better.

When to Start Making Extra Payments: Timing for Maximum Benefit

The sooner, the better! Even if you’re several years into your mortgage, starting extra payments now can still reduce interest and time on your loan.

Navigating Potential Hurdles

Dealing with Loan Servicer Policies: Prepayment Penalties and How to Avoid Them

Check with your loan servicer. Some mortgages have penalties for early repayment. Understanding your loan’s terms can help you avoid unnecessary fees and ensure your extra payments do what they should.

Financial Emergencies: Balancing Extra Payments and Emergency Funds

It’s important not to stretch yourself too thin. Ensure you have an emergency fund in place. This fund acts as a buffer, keeping you on your feet during unexpected financial downturns without derailing your extra payment plans.

Loan Types and Considerations: When Extra Payments May Not Be the Best Option

Investing your extra cash elsewhere might make more sense for some loan types, such as those with extremely low interest rates. Review your financial strategy with a professional to make the best decision.

Maximizing the Impact of Your Extra Payments

Bi-weekly Payments vs. Monthly Extra Payments: Which is Better?

Switching to bi-weekly payments means you’ll make one extra full payment each year without much impact on your monthly budget. It’s an easy way to accelerate your mortgage payoff with minimal pain to your wallet.

Lump-Sum Payments: How and When to Use Them Effectively

Have you received a bonus, inheritance, or tax refund? Consider making a lump-sum payment toward your mortgage principal. These sporadic boosts can significantly reduce your interest obligation over the loan’s lifespan.

Automating Your Payments: Ensuring Consistent Extra Payments

Automating your extra payments can keep you on track without thinking about it each month. Plus, it removes the temptation to spend that extra cash elsewhere!

Conclusion

The journey to reducing your mortgage might seem daunting at first, but you hold the power to drastically change your financial future. By implementing a strategy for extra payments, you can save on interest, build equity faster, and enjoy the freedom of being mortgage-free years ahead of schedule.

So, why wait? Take the first step towards making extra payments this month, and watch how even the smallest amount can transform your mortgage.

what happens if I make a large one-time payment?

what’s the impact of savings if I make multiple large payments at different times?

What are some effective ways to track the impact of extra payments on reducing the mortgage principal over time?

Can you provide examples of how extra payments towards the principal can lead to substantial long-term savings?

How does making extra payments on the mortgage principal affect the overall amortization schedule?

Are there any tax implications or benefits associated with making extra payments on a mortgage?

What strategies can homeowners use to determine the optimal amount for extra payments without straining their budget?

How do different loan terms, such as fixed-rate and adjustable-rate mortgages, impact the effectiveness of making extra payments?

Can you explain how making extra payments affects the total interest paid over the life of the loan compared to making only the minimum required payments?

Are there any online calculators or tools available to help homeowners estimate their potential savings from making extra payments?

What are some common misconceptions or myths about making extra mortgage payments, and how can they be debunked?

In what scenarios would it be advisable for homeowners to prioritize other financial goals over making extra mortgage payments?

How can making extra payments on your mortgage principal save you money in the long run?

What are some potential long-term financial goals that making extra mortgage payments can help you achieve sooner?

How do extra payments towards your mortgage contribute to reducing the total interest paid?

Besides reducing interest payments, what other benefits do extra mortgage payments offer, such as building equity?

How do extra payments shorten the overall duration of your mortgage term?

Can you explain how making extra payments affects the distribution of interest and principal in each monthly payment?

What strategies can you employ to determine the optimal amount for extra monthly mortgage payments?

What tips do you have for staying motivated throughout the mortgage repayment journey, especially when making extra payments?

To learn more details, let’s talk with Amar REALTOR®

Let’s schedule a meeting to review all your Real Estate goals!

![]()

Please Click to schedule a time on my online calendar at no cost!

https://www.amarrealtor.com/meetingwithamarrealtor/

Contact Amar REALTOR® today for more information about Buying/Selling a Home in the Bay Area!

More Interesting Information about Bay-Area Real Estate

Is the Bay Area Housing Market Bottoming Out?

Navigating Online Home Estimates for Maximum Returns

Calendar Guide for Buying and Selling a Home

Common Mistakes People Make When Selling Their Homes

7 Tips for Hosting a Successful Open House for First-Time Home Sellers

What factors impact home value when selling?

What’s the massive difference between Value and Price in Real Estate?

8 Simple Steps for Selling Your Home

Let's Connect with Amar Realtor®

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.