Buydown: A Way to Lower Interest Rates!

Buydown: A Way to Lower Interest Rates!

A Buydown is a mortgage financing technique in which the seller, builder, or moving or relocation company temporarily pays some interest rate costs to reduce the interest rate. The result is a lower monthly mortgage payment for the first few years of the loan. Buydowns are often used to make monthly payments more affordable for buyers who might otherwise be priced out of the market. A Buydown may qualify a buyer who otherwise barely meets income guidelines. There are several ways to structure a Buydown, but most involve some upfront payment.

Who can Buydown A Mortgage?

Homebuyers struggling with a down payment for their home may be interested in learning about mortgage Buydowns. A mortgage Buydown is when the home seller pays a portion of the buyer’s mortgage interest upfront to lower their monthly payments. This can be a helpful way for buyers to make their dream of homeownership more affordable. However, it’s important to note that not all sellers can offer this assistance. Buyers interested in a Buydown should discuss this possibility with a Real Estate Agent, who can help them identify motivated sellers who may be open to the idea.

Who can benefit from a Buydown?

Buydowns offer several benefits. They’re especially useful for those looking to purchase a home with an adjustable-rate mortgage (ARM), as they allow them to reduce their initial payments for the first few years of the loan. Additionally, Buydowns benefit sellers, as they can use them to attract buyers and lower their monthly payments without adjusting their asking price. The company providing the Buydown can also benefit from the arrangement, as they receive regular income throughout the agreed-upon period.

Ultimately, this unique opportunity offers several advantages to buyers and sellers who are part of the agreement. All parties involved must understand what a Buydown entails before entering into such an agreement to ensure everyone is fully informed and ready to take advantage of its many benefits. Knowing what a Buydown entails can help everyone get the most out of their investment.

How to get the most out of a Buydown program?

Every penny saved can make a big difference when buying a house. One of the best ways to save money on a home loan is through a Buydown program. These programs allow buyers to pay less interest in the early years of their loan by making payments upfront before closing.

It’s important to analyze your budget and compare different programs to get the most out of a Buydown program. Considering all the associated costs, such as closing costs, lender fees, and Buydown points, other options work best financially. Once you understand what’s available, look closely at each plan and identify any strategies with minimal initial costs but maximum long-term savings—considering all these factors of a Buydown program when purchasing your new home.

What are the risks associated with Buydowns?

When considering taking on a home loan, people may be given the option of a Buydown. In its most basic form, this involves making an additional up-front payment in exchange for lower monthly mortgage payments during the first few years of the loan. While this can offer several advantages, it’s important to remember that these lower payments come at higher costs later. Considering all possible costs and risks before agreeing to any Buydown arrangement is important. Home buyers can ensure they get the most out of their purchase by understanding exactly what is being decided upon.

Pros and Cons of Buying Down Mortgage Rate!

Buying down the interest rate on your mortgage can have several advantages and disadvantages. On the one hand, it allows you to save money in the long run since a lower interest rate results in smaller monthly payments. This could free up extra monthly cash toward other goals or bills that may be looming. You can refinance your loan with improved credit scores, reducing monthly payments and saving even more money.

On the other hand, there are some drawbacks as well. Buying down an interest rate means you need to pay upfront fees, which can reduce some of the savings; if you plan on selling your property within a few years, these costs could outweigh any potential benefits. Ultimately, buying down an interest rate should only be done when you plan to stay in residence for several years and remain financially stable to reap significant savings over time.

The rate of Home Appreciation is also a very important factor in financial calculations when considering Buydowns.

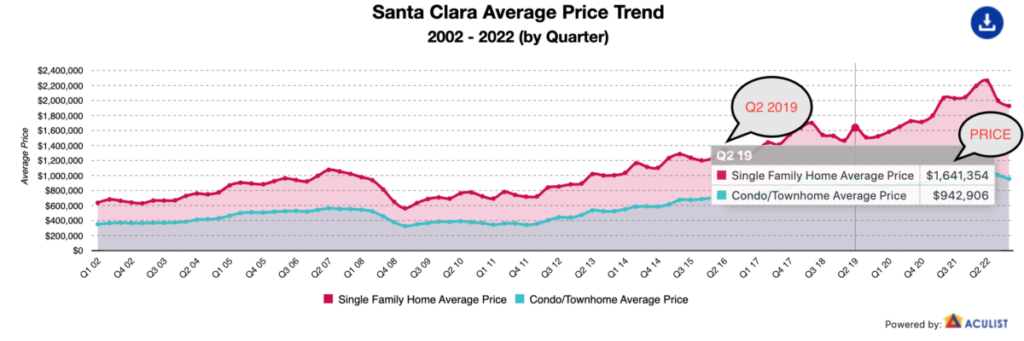

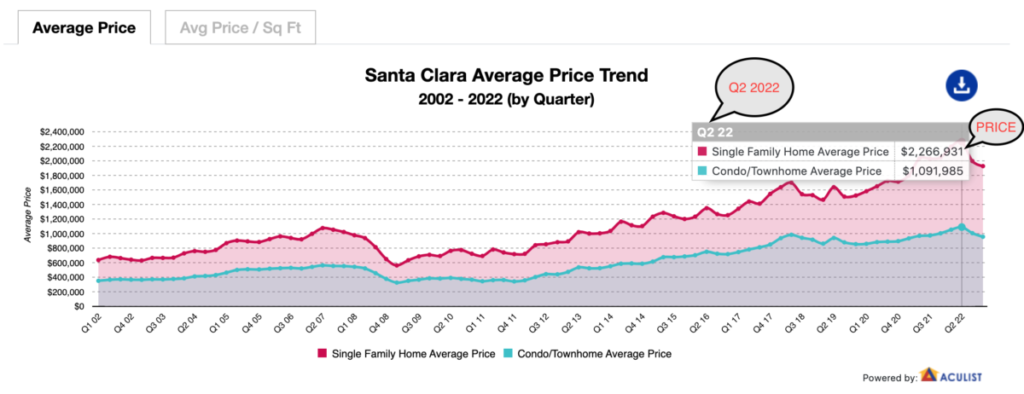

Santa Clara County Market Trends

With its lowered initial interest rates, it offers an opportunity for quicker equity building. This could prove beneficial when it comes time to close on your dream home!

The interactive Santa Clara County Market Trends below gives you the Home Appreciation rate over time.

The Average price of a Single Family Home in Santa Clara County in Q2 2022 is $2,226,931, whereas The Average cost of a Single Family Home in Santa Clara County in Q2 2019 is $1,641,354

►The Single Family Home in Santa Clara County Appreciated $585,577 or 35.68% in 3 years.

The Average price of a Condo/Townhome in Santa Clara County in Q2 2022 is $1,091,985, whereas The Average cost of a Condo/Townhome in Santa Clara County in Q2 2019 is $942,906

►The Condo/Townhome in Santa Clara County Appreciated $149,079 or 15.8% in 3 years.

What are the different types of Buydown programs?

There are two main types of Buydowns:

Each Buydown program has advantages and disadvantages, so choosing the right program for your needs is important.

- Temporary

- Permanent

With a temporary Buydown, the buyer pays a lump sum at closing to reduce the interest rate for the first few years of the loan.

A permanent Buydown, on the other hand, results in a lower interest rate for the duration of the loan. Buydowns can effectively lower monthly payments.

3-2-1 Buydown Mortgage or Program?

Are you looking to purchase a home? You’ve probably heard of traditional mortgages, but have you considered a 3-2-1 Buydown mortgage? This type of mortgage can be advantageous for those looking to purchase a home. Let’s explore what this type of mortgage entails and why it might be the right choice for you.

A 3-2-1 Buydown mortgage is a mortgage in which the interest rate is lowered for the first three years of the loan. Homebuyers often use this type of mortgage, which can be a good option for those looking to save money on their monthly mortgage payment.

The interval and amount of the interest rate discount are determined when the loan is initiated. After the initial discount period, the interest rate on a 3-2-1 Buydown mortgage will adjust according to prevailing market rates.

Example:

If a borrower obtains a 3-2-1 Buydown mortgage with an initial interest rate of 6%, the rate will lower to 3% after the first year; in the second year, it will drop to 2%; and in the third year, it will lower to 1%.

- First-year, 3% interest rate( 6% – 3% ) instead of 6%

- Second year, 4% interest rate( 6% – 2% ) instead of 6%

- Third year, 5% interest rate( 6% – 1% ) instead of 6%

3-2-1 Buydown mortgages can provide significant savings for borrowers in the short term. If you want to purchase a home and take advantage of lower market rates without locking into long-term fixed loan terms, consider exploring whether a 3-2-1 Buydown mortgage might be right for you!

2-1 Buydowns

A 2-1 Buydown is a type of mortgage financing where the lender agrees to temporarily lower the interest rate for the first two years of the loan. This can be an attractive option for borrowers who expect their income to rise during that time, as it effectively reduces their monthly payments for the first two years. Overall, a 2-1 Buydown can be a helpful tool for borrowers expecting their incomes to rise soon.

Example:

If a borrower obtains a 2-1 Buydown mortgage with an initial interest rate of 6%, the rate will lower to 2% after the first year and then to 1% in the second year.

- First-year, 4% interest rate( 6% – 2% ) instead of 6%

- Second year, 5% interest rate( 6% – 1% ) instead of 6%

There are several benefits of a 2-1 Buydown mortgage. First, it allows borrowers to qualify for a lower monthly payment during the loan’s early years. This can be helpful for borrowers who are tight on cash or are trying to reduce their monthly expenses. As a result, a 2-1 Buydown can provide considerable advantages for borrowers.

1-0 Buydown

A 1-0 Buydown is a type of mortgage financing where the lender pays one point of interest on behalf of the borrower at closing. This results in a lower interest rate for the first year of the loan, after which the rate returns to its normal rate. Buydowns can be an attractive option for borrowers looking for a lower monthly payment during the early years of their loan. If you’re considering a 1-0 Buydown, compare offers from multiple lenders to ensure you get the best deal possible.

How to find the best Buydown program for you?

Amar REALTOR® understands that buying a home can be an overwhelming experience. Amar REALTOR® recommends starting with your lender to find the best Buydown program for your needs. Lenders offer different Buydown programs at varying rates and terms, so speak with your lender about your options.

Additionally, Amar REALTOR® can refer you to trusted lenders who understand all aspects of Buydown programs. Finally, Amar REALTOR® is here to guide you through finding the perfect program for you, from understanding what each one offers to ensure that your paperwork is handled accurately and promptly. With Amar REALTOR® as your partner in finding the best Buydown program, we’re confident you will have a successful home-buying experience!

A Buydown mortgage is a great way to save money on your home loan. Borrowers can lower their monthly payments and interest rates by paying interest rate costs upfront. This can help borrowers qualify for bigger loans or make it easier to afford a home and build home equity faster. If you plan on staying in your home for the long haul, a Buydown can be an excellent way to save money.

To learn more details, let’s talk with Amar REALTOR®

Let’s schedule a meeting to review all your Real Estate goals!

![]()

Please Click to schedule a time on my online calendar at no cost!

https://www.amarrealtor.com/meetingwithamarrealtor/

Contact Amar REALTOR® today for more information about Buying/Selling a Home in the Bay Area!

More Interesting Information about Bay-Area Real Estate

A History of Mortgage Rates: What Does it Mean for Home Buyers?

Google Village in Bay Area: What You Need to Know?

How to Get Ready to Purchase a Home: Tips From a Mortgage Loan Officer

Record high: U.S. homeowners have over $27 trillion in home equity

The Difference Between Federal Funds Rate and Mortgage Interest Rate

How the Federal Reserve Affects Mortgage Interest Rates