Housing Wealth: The Missing Piece of the Affordability Equation

Housing Wealth: The Missing Piece of the Affordability Equation

The real estate market is soaring today. Residential home values are rising, and that’s a big win for homeowners. In 2020, home values increased by double digits—a trend expected to reach similar levels this year. However, skyrocketing prices are causing some to question affordability in the current housing market. Many are quick to emphasize the fact that homes today are less affordable than they were last year. Black Knight, a leading provider of data and analytics across the homeownership life cycle, just reported on the issue.

The findings show the historical averages of the national payment-to-income ratio, which they define as “the share of the median income needed to make the monthly payments on the median-priced home.” Their study reveals:

- The average over the last 25 years was 23.6%

- The average in the previous five years was 20.1%

- The average today stands at 20.5%

Currently, housing payments are slightly less affordable than the five-year average—but only by less than ½ percentage points. However, they’re significantly more affordable than the 25-year average. Put another way, a buyer will likely make a slightly greater financial sacrifice to afford a home right now than if they purchased one within the last five years. On the other hand, it also means the potential financial gift is not nearly as great as it was in the previous 25 years.

Does making a sacrifice to buy a home today make financial sense in the long term?

Last week, the Federal Reserve announced that, in the first three months of the year, household net worth increased by $968 billion based solely on the real estate values they owned. Another report from CoreLogic reveals the average annual gain in homeowner equity was $33,400 per borrower.

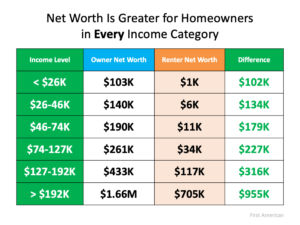

Homeownership continues to be the cornerstone of building personal wealth. For most Americans, their home is the largest asset they own. On top of that, the difference between the net worth of homeowners and renters is significant at every income level. Here’s a table detailing that point using data from a study done by First American:

Owning a home is essential to growing a household’s net worth. Despite the slightly greater sacrifice in the percentage of monthly income you’ll spend on housing today, for most homebuyers, the payoff of starting to build equity now will be worth it.

To learn more details, let’s talk with Amar REALTOR®

Let’s schedule a meeting to review all your Real Estate goals!

![]()

Please Click to schedule a time on my online calendar at no cost!

https://www.amarrealtor.com/meetingwithamarrealtor/

Contact Amar REALTOR® today for more information about Buying/Selling a Home in the Bay Area!